Forecasting Of Effects Of Covid

The statistical models demonstrating the sheer implications of unemployment increases and national income over 20002017 provide the basis for understanding, and ultimately estimating, the potential future mental health and suicidal impact of the recessional phenomena during the ongoing, and rapidly continuingin terms of its consequent production of economic recession. But at this point we do not know how intense or lengthy the COVID-19 recession will be among industrial democracies of the OECD. Equally important, we have no foreknowledge of what the individual governments may invest in unemployment, business, welfare, health care, and educational relief and stimulus to maintain economic stability and mitigate poverty as COVID-19 and its sequelae proceed. It is clear that different governments are responding in different ways. Further, the epidemiological literature indicates that the economic impact of employment and income loss and poverty may lag over a range of at least 510 years, if not a generation. Therefore, the coefficients showing twenty-first century relations between income and employment loss and mental health, must, in practical policy discussions, be stated in terms of scenarios that refer to potential policy decisions on the part of governments.

Indicated By Weak Output Andrising Unemployment Rates

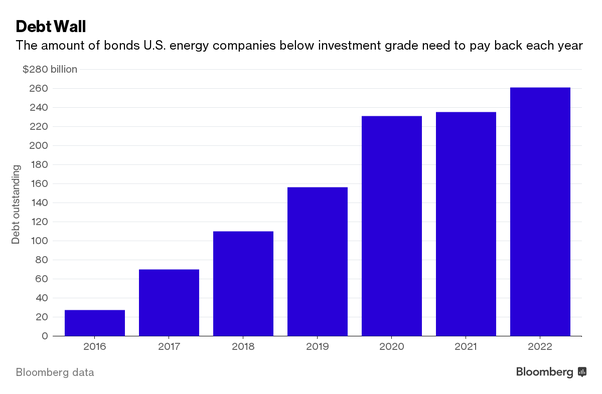

A recession can be defined as a sustained periodof weak or negative growth in real GDP that is accompanied by a significant rise in theunemployment rate. Many other indicators ofeconomic activity are also weak during a recession.For instance, levels of household spending andinvestment by businesses are usually low. In addition,the numbers of households and businesses that areunable to pay back loans are unusually high, as isthe number of businesses that close down. Becausethese indicators are typically present when thereis a significant increase in the unemployment rate,the unemployment rate is considered a reliable andtimely summary indicator of a range of negativedevelopments in an economy.

When Have Recessions Ordepressions Occurred Inaustralia

There are several episodes of very weak economicactivity in Australia that are recognised asrecessions or depressions by most economists.There are also some episodes of weak economicactivity where there is disagreement amongeconomists about whether these were recessions,in part because of the different definitions ofrecession that can be used.

You May Like: Can Anxiety Cause You To Faint

The Inverted Yield Curve: A Trusted Recession Predictor

There are many indicators experts use to predict when a recession may occur, and the most reliable is an inverted yield curve.

Typically, interest rates for short-term loans are lower than rates of long-term loans. That’s partly because a short-term loan is seen as a riskier investment for the lenders and partly because inflation is built into the interest rates.

For example, $1,000 today is not going to be as valuable as $1,000 in 10 years, and higher interest rates seek to mend that. When this model is inverted, it can be a sign of a worsening economy, because it shows that there is less confidence in the long-term than there is in the short-term.

An inverted yield curve worries the market because it means “an expectation of low inflation, which comes with economic downturns” says Laura Ullrich, regional economist with the Federal Reserve Bank of Richmond, adding that inverted yield curves signal that people are “searching for safer places to put their money.”

Since 1955, an inverted yield curve has predicted each recession, and it should be noted that the curve did invert in 2019. Ullrich warns that there were other economic forces abroad that caused the most recent inversion.

Potential Effects Of Mental Health Services

It is worth looking at the impact of COVID-19 on mental health in stages. For example, first stage of quarantine, self-isolation may bring with it certain stressors especially if individuals are living by themselves or nuclear family settings in many high income countries. Second stage will be of infection and isolation either at home or in hospital. Bereavement as a result of death of a loved one and inability to attend funerals in lockdown situations will affect coping with grief and may well-lead to abnormal grief reactions. In many countries an inability to perform rituals after a death can further add to distress and resulting depressive feelings. Some individuals may go on to experience survivor guilt. Each of these observable stages will affect mental health and well-being of individuals. In low income countries which may be socio-centric, additional pressures may play a role. Thus, the fear of catching the infection can lead to avoidance anxiety, the sense of being entrapped can lead to depression and grief reaction due to loss and bereavement followed by managing survivor guilt and each of these conditions can contribute to increased likelihood of self-harm or suicide. In all the preparations for dealing with the pandemic, the emphasis initially was on prevention and then treatment, the focus on mental health emerged later. In dealing with mental ill-health the focus must be on individual, family, community, and then national and global responses.

Recommended Reading: Psychosis Untreated

In What Ways Are Jobs Changing

In previous research, I showed that recessions are an opportune moment for employers to change how they produce. In the Great Recession, many employers took the opportunity to restructure their processes toward cheaper, labor-replacing technologies, and they consequently laid off certain sets of workers in favor of machines. Those employers then needed a different type of worker to help operate those machines. Think of grocery stores that installed self-checkout machines. The technology existed before the Great Recession, but was not widely adopted until then. Thats one reason we had a jobless recovery at the time. We expect something similar might happen following the coronavirus recession. Employers might be especially concerned about relying too much on in-person activities and desire to shift towards remote work. The economy as a whole might shift towards products that can be consumed remotely .

Why Was There A Recession In The Us In 2019

The IMF blamed heightened trade and geopolitical tensions as the main reason for the slowdown, citing Brexit and the ChinaUnited States trade war as primary reasons for slowdown in 2019, while other economists blamed liquidity issues. In April 2019, the U.S yield curve inverted, which sparked fears of a 2020 recession across the world.

Recommended Reading: What Is A Phobia Of Bees Called

Which Consumerism During The 1920s Boosted The Economy

The increase of consumerism in 1920s is created because of the early development of credit card companies. At that time, there is not strict regulation on credit score, which mean that even those who do not have high enough income would obtain low interest credit. This lead to a massive increase in average debt.

Control For Education And Other Confounders

Added to the most visible outcomes of government austerity on poverty minimization are declines in government investment in education. This has not only had very serious effects on the ability of younger workers to develop careers in times of recession, but have led to longer-term effects on life time earnings and loss of productivity gains. The latter point of productivity growth diminution is estimated to have important implications for at least the next generation of workers and governments .

Further compounding previous analyses of mental health effects due to recession has been the lack of use of multivariable models predicting, e.g., suicide, but taking into account other major sources of risks than the immediacy of recession, such as alcohol and drug abuse or accidental mortality. And, as indicated earlier, the lack of control for such potential risks often hide significantly the inherent suicidal intent , of suicidal behavior represented by such risks. Thus, the absence of control for such factors, at the very least, increases the risk of misestimation of the actual level of suicide that is contingent upon economic damage.

Read Also: Phobia Of Puke

The Difference Between A Recession And A Depression

Recessions and depressions have similar indicators and causes, but the biggest differences are severity, duration, and overall impact.

A depression spans years, rather than months, and typically sees higher unemployment and a sharper decline in GDP. And while a recession is often limited to a single country, a depression is usually severe enough to have global trade impacts.

Because economists do not have a set definition for what constitutes a depression, the general public sometimes uses it interchangeably with the term recession. But in the U.S., there has only been one depression: The Great Depression of the 1930s, which spanned 10 years.

Growth In Purchasing Power Of Workers Wages And Benefits Has Not Kept Pace With Productivity Growth

Productivity growth is the key to a rising material standard of living. Employers can afford to pay workers more without threatening their bottom line when their workers produce more per hour worked and when businesses can charge higher prices for the goods and services they sell. Workers enjoy a rising material standard of living when their earnings rise faster than the cost of the goods and services they buy.

From 1948 to 1973, productivity and the real average hourly compensation of workers in the nonfarm business sector each nearly doubled, irrespective of whether inflation is measured using producer prices or consumer prices. From the mid-1970s to the mid-1990s, however, productivity growth slowed. At the same time, compensation per hour adjusted for inflation in consumer prices grew much more slowly than productivity, while compensation adjusted for inflation in producer prices grew at roughly the same rate as productivity.

Productivity picked up considerably in the late 1990s and early 2000s but was disappointingly slow in the expansion following the Great Recession. Workers saw a brief spurt in their real compensation in the second half of the 1990s but have seen little progress since. Productivity has grown faster than compensation adjusted for producer prices since the turn of the century, indicating that producers have been able to increase their profit margins, raising capitals share of nonfarm business income at the expense of labors share.

Read Also: Starting Pristiq Side Effects

What Is A Depression

Depressions are simply more severe than normal recessions and their effects can be felt for years. As such, getting through a depression can be a challenge for consumers and businesses alike.

In the U.S., the most well-known example is the Great Depression of the 1930s. This term actually refers to two officially dated recessions, with a period of mild growth in between during which the economy did not recover to its pre-recession peak before diving back into recession. The first occurred from August 1929 to March 1933, during which GDP declined by 33%. The second ran from May 1937 to June 1938, during which GDP declined by 18%.

Individual Vs Population Approaches To Anxiety Depression

From the earliest days of psychiatric epidemiology , the evidence has been robust and clear that lower socioeconomic groups evidence higher rates of mental disorder in a dose-response, relatively linear gradient. This traditional literature has often been interpreted in materialistic terms, but more analytical researchers such as Hollingshead and Redlich and Leighton have focused on psychological stress interpretations of the social class-mental health relationship.

You May Like: Panic Attack Blurry Vision

Can Recessions Have Long

The social and economic costs of recessions canbe large and persistent. The central bank andother economic policymakers seek to ensure theeconomy continues to grow at a sustainable rateto avoid any unnecessary slowdown in economicactivity. If a negative shock does occur that causesactivity to slow, policymakers will attempt tostimulate the economy to try to avoid a recessionand minimise the economic costs faced byhouseholds and businesses.

There can be long-term consequences from anincrease in unemployment and business failuresthat occur during recessions. Some people whobecome unemployed in recessions face long-termunemployment, even when normal rates ofeconomic growth resume. This is because duringa recession their work skills may have reducedthrough lack of use, or because employersmay think that this has occurred. Long-termunemployment can also occur because arecession can speed up structural changes tothe way the economy works. Reflecting thesedevelopments, the unemployment rate aftereach recession tends to be higher than before theeconomy entered a recession and takes a longtime to decline.

The rise in unemployment that occurs duringa recession results in increased economichardship that is borne unequally across society. This, in turn, reduces theopportunities available to households directlyaffected by the recession and can have long-termeffects on their health, learning, achievementof qualifications and social mobility .

Employment Growth Has Resumed After Covid

Through February 2020, total payroll employment had risen for 113 straight months. Private employment had risen for 120 straight months, but total government employment was barely above what it was at the start of the expansion. Large employment losses in March and April 2020 wiped out a large share of those gains.

Total nonfarm employment fell by a staggering 20.7 million jobs in April 2020, largely erasing the gains from a decade of job growth. Despite job gains in every month since, including an increase of 1.1 million jobs in July 2021 and most recently 210,000 jobs in November, there were still 3.9 million fewer jobs on private and government payrolls in November 2021 than there were in February 2020.

Private employment rose by 235,000 jobs in October but remains 3 million jobs below its February 2020 level. Federal government employment increased by 2,000 state employment declined by 9,000 and local employment declined by 18,000 .

You May Like: What Is A Depression Contour

Average Hourly Earnings Growth Since Start Of Recession Distorted By Sharp Decline And Partial Recovery In Number Of Low

Average hourly earnings of employees on private payrolls grew modestly through much of the recovery from the 2007-09 recession, and through February 2020, wage growth averaged 2.4 percent annually. Inflation was modest as well, but over much of the expansion, real wages failed to keep up with increases in workers’ productivity, as we discuss below in Part III.

The pace of wage growth quickened in 2015 and into 2016 but subsequently stalled below 3 percent until 2018, when it began edging up again. The upward trend in earnings growth for all employees stalled in 2019, however, despite very low unemployment. Low inflation led to solid real wage gains in 2015 and 2016 and to a lesser degree in 2019.

Average wage growth increased sharply after February 2020, but not because of widespread wage gains. Rather, large numbers of lower-wage workers bore the brunt of the job losses in the recession and the shift in the composition of total payroll employment toward higher-paid jobs was large enough to temporarily raise the average wage substantially. The partial recovery in low-wage jobs had the opposite effect.

Extraordinary circumstances in the pandemic recession have continued to distort recent 12-month changes, but wages do seem to be on the rise. The monthly average annual earnings data will be a poor guide to trends in worker pay, however, as long as the composition of the labor force is changing as the recovery in low-wage job continues.

What Are The Five Stages Of Economic Growth

Rostows Stages of Economic Growth include the following five stages: Traditional Society Preconditions for Take-Off Take-Off Drive to Maturity and Age of High Mass Consumption. Rostows model is one of the most significant historical models of economic growth. The model does not include Postmodern Society.

You May Like: Dehydration Cause Anxiety

Problem Of Suicide Definition

Further, exacerbating this issue of definition lies in trying to determine time sequences. Thus, the heightened risk of suicide due to alcohol abuse may result in mortality that is not easily attributable to suicide, but the reaction of a loved one to such mortality could eventuate in suicide. Such reactions are not uncommon in the case of widow or widower suicides upon learning of the deaths of a spouse, for example . And a similar literature has been reported for adolescents . It is frequently difficult to ascertain whether illness or disturbed life circumstances due to alcohol or drug abuse or accidents or other trauma, themselves embody suicidal intentor result in reactions of persons closely related who then go on to actually suicide.

The ultimate definitional question then is to what degree do deaths attributable to factors such as accidental poisoning, traffic accidents, or drug abuse represent suicides and need to be added to the category of suicides, perhaps in a broader concept such as deaths of despair. Another complicating factors is what Durkheim called anomie and deserves further detailed study.

What Caused The Great Depression

The Great Depression was one of the most severe economic downturns in history lasting from 1929-1939. It started in America in 1929 as a recession before expanding globally, most notably in Europe.

As with any long-term economic crisis, there wasn’t just one event that led to the Great Depression, but rather a series of events including the stock market crash of 1929 and the severe drought of the Dust Bowl in the 1930s.

The economy was already trending downward over the summer before the crash, with unemployment rising and manufacturing declining, leaving stocks significantly overvalued. Then on October 24th, known as “Black Thursday,” investors sold off almost 13 million shares of stock, signaling to consumers that they had been right about their lack of confidence. Spending came to a halt, debt increased, homes were foreclosed, and banks began failing.

The stock market crash in October of 1929 kicked off a panic that resulted in a severe drop in consumer spending and investing, which led to a drop in manufacturing, which led to increased unemployment and most banks in the country failing.

You May Like: Aspirin For Anxiety Attacks

What Should Fiscal Policy Do Now

With interest rates extremely lowinflation-adjusted, or real, interest rates are negativethere is little cost to borrowing heavily and doing what turns out to be too much. On the other hand, there is a tremendous cost to underestimating the extent of the problem and doing too little. We need to err on the side of doing more rather than less. This is especially true now because the Fedwhich helped stabilize the economy in the Great Recessionhas much less room now with the benchmark federal funds rate before any hint of the coronavirus at just 1½ percent. In 2007, the federal funds rate was 5¼ percent, so the Fed had a lot more room to cut.