Whats The Difference Between A Recession And A Depression

Whats the difference between a recession and a depression? Most think of a depression as simply a really bad recession, but they are two distinct but naturally occurring events.

The 2020 coronavirus crash is not a normal recession given pure monetary policy is ineffective being at the zero interest rate lower-bound and rates further out along the curve at or very near zero as well.

The ineffectiveness of monetary policy is causing financial assets to fall faster than they did during the Great Depression, 1987 , and the 2008 financial crisis.

Investors are pulling back from corporate bonds at the fastest pace ever. An index or raw materials is hitting all-time lows. Funding shortages have produced a dollar squeeze, pushing the US currency to around an 18-year high.

What Causes A Recession

The causes of recessions are complex and often interrelated. But, in very general terms, recessions can be caused by such factors as:

- high inflation

- asset bubbles

- overextended credit and high debt

- bank runs and lack of consumer confidence

- trade wars

- problems in financial markets, policies, and regulation

Now, we saw bears and bulls above. Lets add another creature: the black swan. A black swan is a metaphor for something that is extremely rare . In market-speak, a black swan is a rare and unpredictable event that can have disastrous consequences for the economy. The 2020 coronavirus pandemic has been popularly referred to as a blackswan, as the outbreak froze large parts of the economy around the world to contain the spread of the virus and causedaccording to many expertsa recession.

What Caused The Great Depression

The Great Depression was one of the most severe economic downturns in history lasting from 1929-1939. It started in America in 1929 as a recession before expanding globally, most notably in Europe.;

As with any long-term economic crisis, there wasn’t just one event that led to the Great Depression, but rather a series of events including the stock market crash of 1929 and the severe drought of the Dust Bowl in the 1930s.;

The economy was already trending downward over the summer before the crash, with unemployment rising and manufacturing declining, leaving stocks significantly overvalued. Then on October 24th, known as “Black Thursday,” investors sold off almost 13 million shares of stock, signaling to consumers that they had been right about their lack of confidence. Spending came to a halt, debt increased, homes were foreclosed, and banks began failing.;

The stock market crash in October of 1929 kicked off a panic that resulted in a severe drop in consumer spending and investing, which led to a drop in manufacturing, which led to increased unemployment and most banks in the country failing.;

Read Also: Fear Of Weather

Are Recessions And Depressions Really That Bad

Thats the difference between a recession and depression in economic terms. Now you might wonder if there are any upsides to cyclical downturns in the economy

Most of us view recessions with caution. But its important to note that theyre a normal part of the business cycle.

As the saying goes, What goes up must come down. Expansionary periods cant go on forever. Eventually, an economic boom will start to lose steam, and the economy will start to contract.

Buddy Do You Have A Dime

We can all think back to the time when the stock market was rising and the mentality was that while something may occur that may disrupt business activity for a short period, the U.S. economy was going to continue to chug along. Its hard to contemplate, but that period was just four short weeks ago.;

The stock market has since sold off by approximately 30% over the last four weeks. Long-term interest rates declined to an eye-popping .5% over that period of time as well. The financial market activity has been stunning, as the percentage losses in the stock market eclipse what many including myself had been expecting. It appears margin calls are ongoing, with selling begetting selling.; I can go on, but you get the picture.

Im hearing the word depression being kicked around Wall Street.; Some fear that the worlds economy has entered a new depression and not a recession. I dont buy it.;

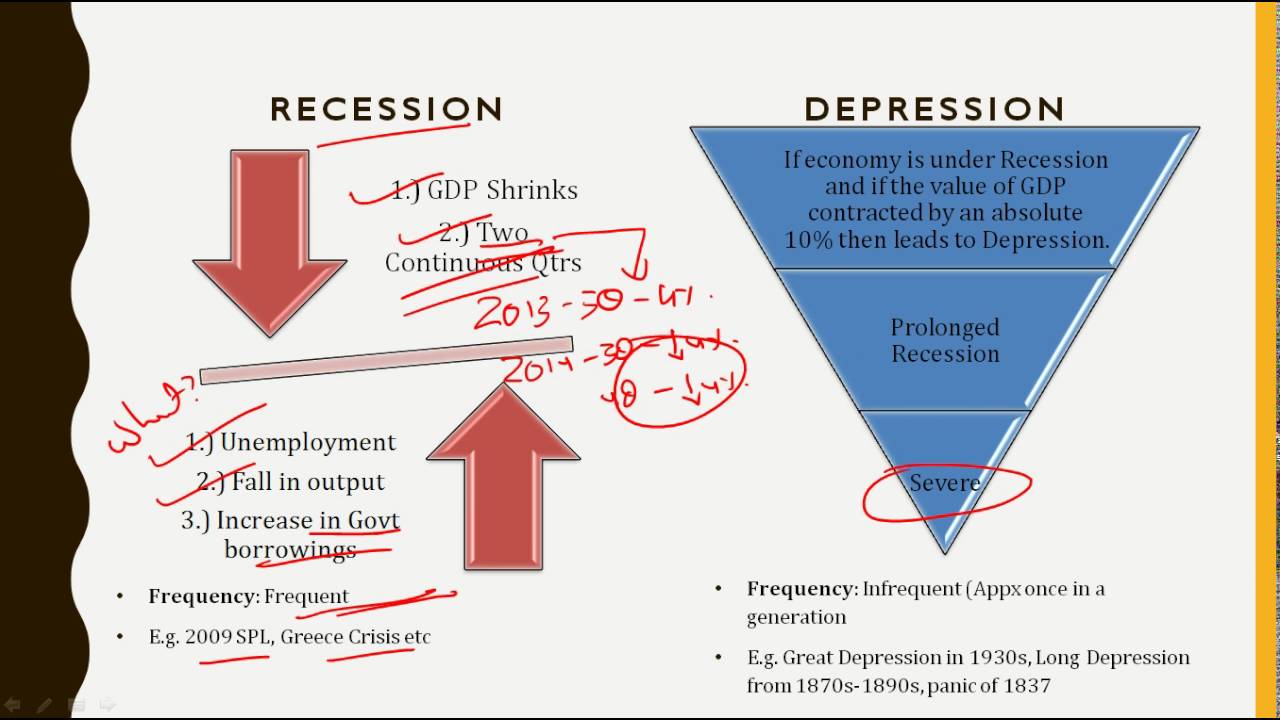

What is the difference between a recession and a depression? It is generally agreed that a recession is period where real gross domestic product declines for at least two quarters in a row.; Normally, unemployment doesnt rise above 10% or so in recessions. The stock market, on average, declines by 30 35% during a recession. A depression is, like a recession, a period of GDP contraction, but it can last years, not quarters. Unemployment reached a high of 24% during the last depression. The stock market dropped by 80%+ .

Recommended Reading: What Is The Phobia Of Throwing Up

Whats The Difference Between A Recession And Depression

The difference between a recession and a depression includes both the severity of economic decline and how long it lasts. A recession is defined as a downturn in the economy that lasts for more than six months or two quarters. A recession turns into a depression when the economy stays in decline for several years.;

Remember, all recessions and depressions will look a bit differently. Not one is the same as another, so its hard to say what the next may look like.;

You may also like: When Will the Economy Recover From Coronavirus?

For example, one of the key economic indicators of a recession is unemployment rate. During a recession, unemployment can reach 10 percent. Whereas unemployment during the Great Depression reached 25 percent.;

Since Coronavirus hit and many U.S. cities went on lock down, over 26 million Americans have applied for unemployment. As a result, the unemployment rate is now hovering around 23%, according to Paul Ashworth, chief U.S. economist at Capital Economics.;

While this surge in unemployment may lead to a comparison with the Great Depression, Ashworth believes those worries are misplaced. Many of the unemployed have been furloughed and will return to their normal jobs when the stay-at-home orders have been lifted. He expects the unemployment rate to fall quickly once the economy restarts.

So what causes an economy to go into a recessionary period to begin with? There are five key indicators to watch that signify the overall health of the economy.;

Where Are We In The Current Business Cycle

The best way to find out if we are in a recession or a depression is to understand where we are in the;business cycle. A recession typically follows;the peak of the business cycle. The peak is marked by;irrational exuberance;and;asset bubbles.

In early 2020, the U.S. economy entered the contraction phase of the business cycle. The 2020 recession was caused by the COVID-19 pandemic. The government closed non-essential businesses and urged people to stay at home to stop the spread of the virus. The economy contracted 5.0% in the first quarter of 2020. By April, there were 23.1 million unemployed, sending the unemployment rate to 14.7%.

Don’t Miss: Hippopotomonstrosesquipedaliophobes.

Governments Weren’t Much Help In The Depression

Economic mismanagement played a key role in turning the stock market crash of 1929 and the recession that followed into the Great Depression.

“The classical economic approach involved reducing wages and trying to balance their budgets,” Terry Rawnsley explained.

“All of which just further reduced aggregate demand in the economy and worsened the Great Depression.”

Not only did governments generally slash spending in response to their falling revenues and rising debts, they also didn’t provide even much basic support for the growing ranks of unemployed.

State Library of NSW

In his 2009 speech, Dr Gruen observed that Commonwealth unemployment and sickness benefits weren’t introduced until 1945.

“During the Great Depression, state governments had a support payment called ‘the susso’, short for sustenance payments,” he said.

“These varied by state but provided bare minimum support, with strict controls on what could be purchased with the coupons provided.”

They didn’t pay the rent, which saw many shanty towns and tent cities spring up around the country, and inspired this children’s ditty:

We’re on the susso now,

We can’t afford a cow,

We live in a tent,

We pay no rent,

We’re on the susso now.

The contrast with the modern response to severe economic downturns couldn’t be more stark.

In early 2009, the Rudd government announced a $42 billion stimulus package to help offset the effects of the global financial crisis unlike most developed countries, Australia avoided recession.

Depression Definition: What Is A Depression

There is no agreed definition for a depression, but it is widely considered as a more prolonged and severe form of a recession. However, the IMF says some consider a decline in GDP of over 10% as a depression. Ultimately, it is an extended and sharper economic downturn that has greater consequences on the long-term prospects for its recovery.

A depression will always be borne out of a recession, but there is a debate over when one ends. Some believe a depression ends as soon as an economy starts to grow again, while others think it only ends once growth and output start to return to pre-crisis levels.

Recommended Reading: Celine Dion Health Condition

Stay Calm And Carry On

The market in general has been in waterfall mode. The current waterfall stock market move is similar to the two previous rapidly declining market experiences. These previous panics lasted between two to three months. The current bear market is well along the path that was blazed by the two previous declines.

Bottom line: Resist the urge to panic. While the financial system may continue to swoon with stock prices declining further, the market has already declined dramatically. Very good values are available in high quality companies shares. We need to remember that this is Americaour country and our people have been through a lot before.;We will make it through this. And finally, this isnt, in my opinion, the start of an economic depression.;;

1Wikipedia:;Causes of the Great Depression

Getting Rid Of Excess

The decline in economic growth let an economy to shed out the excess. Automatically, the amount of inventory reduces and reach reasonable levels. Firms which have staggered along during the period of expansion runs out of business and let labor and capital bound by them to be used in more productive ways.

The term creative destruction is coined by Joseph Schumpeter, a 20th-century Austrian economist. He said that capitalism is a continuous process of destruction and also renewal where entrepreneurs play an important role in refurbishing the system.

Recommended Reading: What Is The Meaning Of Phobia

What Are The Differences Between A Recession And A Depression

Think of a recession and a depression as economic cousins. They share some DNA, but they dont look alike. Here are four of the key factors that set them apart:

- GDP during a depression declines for an extended period, usually at least two years. In a recession, a decrease in GDP is relatively short-lived.

- A depression-era fall in GDP typically amounts to at least 10 percent. During a recession, the drop in GDP would be lower.

- The unemployment rate during a depression reaches 20 percent, while the unemployment rate in a recession might be closer to 10 percent.

- Consumer spending normally goes down during a depression but might be steady during a recession.

Keep in mind, though, that theres no textbook definition of a depression. Therefore, a certain span of time might qualify as a depression but might not perfectly match the previously mentioned benchmarks.

A Brief History Of Past Recessions

According to NBER, there have been 33 recessions since 1854. The shortest one lasted just six months, from January to July 1980; the longest one, the Panic of 1873, which gave way to the Long Depression, lasted 65 months from October 1873 to March 1879.

The first noted recession was the Panic of 1857, which lasted from June 1857 to December 1858 and was sparked by the failure of the Ohio Life Insurance and Trust Company, which caused a loss of confidence in American banks and led to the failure of more than 5,000 businesses.;;

The most recent one was the Great Recession of 2008, which officially began in December 2007 and ended in June 2009. It was caused by the subprime mortgage crisis, which led to the collapse of the housing market and a subsequent bank crisisand was part of a global financial crisis. Between 2007 and 2011, more than half of all families lost at least 25 percent of their wealth and one-quarter of American families lost at least 75 percent of their wealth; and between December 2007 and early 2010, more than 8.7 million jobs were lost

Don’t Miss: Suffix Phobia

Bear Markets Vs Bull Markets

A bear market occurs during a recession when the financial market declines 20 percent. A bull market occurs when the market is trending upward. Often bear and bull markets are referred to regarding the stock market, but these markets can apply to real estate, bonds, commodities, etc.

Bear and bull markets usually mirror the economic cycle. This cycle is made up of four phases and looks like a never ending wave:;

The Risk At The Latter Stage Of The Depression

Toward the latter stages of the process, where policymakers have created enough money to negate the deflationary forces of contracting credit, the next risk is related to currency weakness.

As mentioned, printing money is bearish for a countrys currency, holding all else equal. The risk is that the increased supply of money will make short-term debt even sovereign short-term debt, which is virtually risk-free unattractive. It is particularly unattractive to foreign investors who care not about inflation-adjusted return like domestic investors, but rather what their return will be when converted into their own currency.

Currency weakness tends to cause capital flight and the buying of inflation-hedge assets, rather than policymakers intended effect of credit creation.

If interest rates are at zero which they are or close to it when the primary form of monetary policy and secondary monetary policy are out of room then if youre a foreign investor you probably dont like an asset giving you zero percent return.

If that currency declines, then your asset will provide you with a negative return. Accordingly, owning that debt probably doesnt seem very attractive to you.

Moreover, for domestic investors, you care about your real return. If that debt is giving you zero percent and inflation expectations over your holding period are above zero, then your real return is negative.

Recommended Reading: How To Stop Bulimia And Lose Weight

The Difference Between A Recession And A Depression

Recessions and depressions have similar indicators and causes, but the biggest differences are severity, duration, and overall impact.

A depression spans years, rather than months, and typically sees higher unemployment and a sharper decline in GDP. And while a recession is often limited to a single country, a depression is usually severe enough to have global trade impacts.;

Because economists do not have a set definition for what constitutes a depression, the general public sometimes uses it interchangeably with the term recession. But in the U.S., there has only been one depression: The Great Depression of the 1930s, which spanned 10 years.;

Are We Headed For The Next Great Depression

The United States has enjoyed a Bull Market for the last 11 years. Now were sliding fast into recessionary waters. There has been plenty of talk about if the COVID-19 pandemic will cause the next Great Depression. The bottom dropped out of the economy in 1929 and now in 2020. Does this mean a depression is inevitable? Not necessarilyLets compare the two economic climates:

Read Also: What Is The Phobia Of Throwing Up

Indicated By Weak Output Andrising Unemployment Rates

A recession can be defined as a sustained periodof weak or negative growth in real GDP that is accompanied by a significant rise in theunemployment rate. Many other indicators ofeconomic activity are also weak during a recession.For instance, levels of household spending andinvestment by businesses are usually low. In addition,the numbers of households and businesses that areunable to pay back loans are unusually high, as isthe number of businesses that close down. Becausethese indicators are typically present when thereis a significant increase in the unemployment rate,the unemployment rate is considered a reliable andtimely summary indicator of a range of negativedevelopments in an economy.

Could Coronavirus Trigger A Recession Or Depression

Recently,;the International Monetary Fund stated that the negative global growth so far this year could trigger a recession at least as bad as during the 2007-08 global financial crisis or worse. This highlights the severity of the situation that COVID-19 has put on the global economy.

The USA last week announced that it currently had a record number of people who are unemployed, and leading countries around the world are on lockdown meaning more and more people are working from home or have been affected by Furlough Leave.

However, the reason that depression has been used in the same breath as coronavirus in recent weeks, is that the severity of the situation and the incredible damage that has done to the economy is eerily similar to time in the lead up to the 1929 crash.

- South Quay Building, First Floor

- Orega, 189 Marsh Wall

Recommended Reading: Treating Schizoaffective Disorder Naturally

What Is The Differencebetween Recession Anddepression

As with recession, there is no single definitionof a depression. However, a depression canbe thought of as a much bigger version of arecession, both in terms of scale and duration.Consequently, in a depression, there are periodsof falling output and high unemployment ratesthat persist for a number of years.

The scale and duration of a depression meansthat there are often negative economic outcomesthat are experienced in many countries aroundthe world, so some definitions of depression saythat it is a severe recession that occurs in one ormore economies.